what are back taxes owed

The type of agreement you can. IRS offers several tax debt relief programs to you when unable to pay the.

Do You Owe The Irs How To Find Out

Minimizing IRS penalties and interest.

. Claiming any uncollected tax refunds you may be owed. Back taxes are any taxes that you owe that remain unpaid after the year that they are due. Taxpayers can set up IRS payment plans called installment agreements.

Back taxes are taxes from a previous year that you owe that you have not yet paid. The best reasons to file back taxes include. The first letter you will receive.

Although IRS and state tax debt are equally debilitating state tax authorities are often more aggressive in collection action. Form 1040 W-2s for withheld income and 1099s for untaxed income may be needed. You can owe back taxes at the federal.

If you are due a refund for withholding or estimated taxes you must file your return to claim it within 3 years of the return due date. This type of tax debt regularly accrues penalties and fines and. If you cant pay the full amount due at the time of filing consider one of the payments.

Heres a summary of some of the potential taxes that. It may be necessary to contact the IRS to obtain tax records dating back a few years in order to find out what is owing. Here are just a few of the issues that can arise if your business owes back taxes.

And if you owe them you might be wondering about tax relief. Its best for all taxpayers to file and pay their federal taxes on time. April 18 2019.

The same rule applies to a right to claim tax. The decedents income will count from January 1 of the year they passed until the day before they passed. Earning Social Security benefit.

Definition and Examples of Back Taxes. You can call the IRS at 1-800-829-1040 to determine how much you owe. If you dont file a tax return and you owe the IRS money the agency charges Failure to File and Failure to Pay penalties.

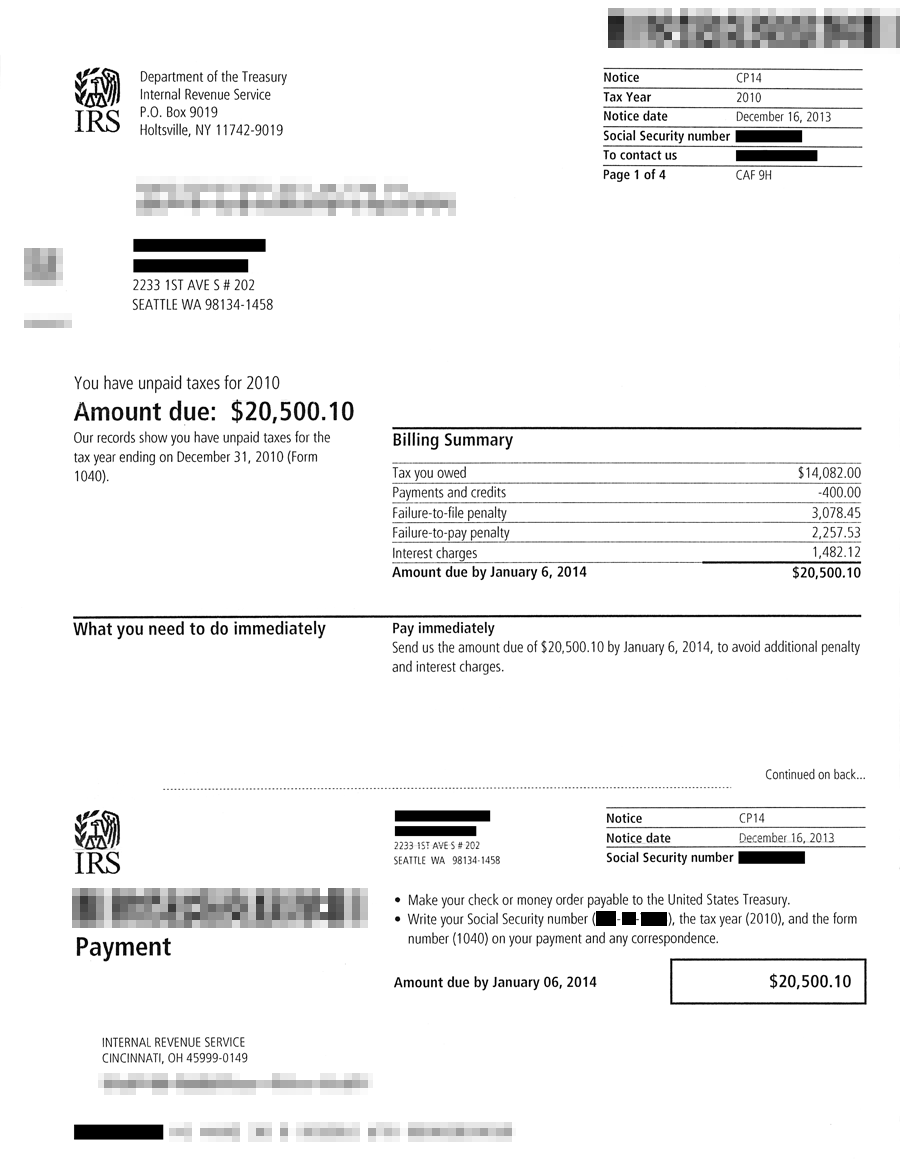

IRS Actions For Unpaid Back Taxes Receive Assessment Letter and CP Notices Computer Paragraph Notices or 500 Series Notices Once the IRS determines that you have back taxes it enters you into the automated computerized notice cycle. In 2009 the IRS estimated that 82 million Americans owed 83 billion in back taxes to the. Two common reasons for owing back taxes are failure to pay your tax liability due and failure to file your tax return.

These letters will let you know how much you owe including additional penalties and interest. Write deceased next to the taxpayers name when filling out tax forms. Nogee a New York City-based partner at the nationwide firm Tully Rinckey PLLC unpaid income taxes and unpaid municipal property taxes can attach to your property.

Back Taxes Owed To IRS are the unpaid taxes when the taxpayer has owed the money to the IRS over the tax year. According to Jeffrey L. IRS telephone assistance is available from 7 am.

Back taxes are the taxes you owe to the Internal Revenue Service that was wholly or partially unpaid the year they were due. Call the IRS to Determine How Much You Owe. Back taxes are taxes that werent paid at the time they were due typically from a prior year.

Interest and penalties accrue. Back taxes are the taxes an individual or business owes to the state or Internal Revenue Service IRS from the previous tax year. As long as your taxes are overdue interest and penalties can add up fast.

Any one of these types of taxes becomes a back tax when it goes unpaid and becomes past-due. When taxes are delinquent or overdue typically from previous years they are referred to as back taxes. Set up an installment agreement with the IRS.

When a person is deceased the tax deadline is automatically pushed to April. What to do if you owe the IRS. Basically if you let an entire filing year go by without paying the IRS what you owe its.

The Failure to File Penalty is 5 of the unpaid tax for each.

Back Taxes Owed Orlando Fl Tax Accounting Firm Cpa

Help Available If Back Property Taxes Owed In Oakland Co The Oakland Press

Things To Know For Divorcing Couples Who Owe Back Taxes

Offer In Compromise Internal Revenue Service

Unfiled Returns Back Taxes Owed Pivotal Tax Resolutions

Back Taxes And Tax Debt Tax Tips And Resources Jackson Hewitt

Tax Letters Washington Tax Services

What To Do When You Owe Back Taxes Infographic Business Tax Business Tax Deductions Tax Help

Unpaid Back Taxes Des Moines Mobile Accounting Corporate Taxes Services And Personal Taxes

If You Owe Back Taxes Try Making The I R S An Offer The New York Times

Back Taxes Owed On Foreclosed Property Might Fall On Buyer Thinkglink

Solve Irs Tax Debt My Tax Hero

San Diego Ca Cpa Firm Back Taxes Owed Page Regal Group Cpa

How To Check For Property Back Taxes And Liens For Free In 2020 Compass Land Usa

Back Taxes And Tax Debt Tax Tips And Resources Jackson Hewitt